TERC LPEM FEB UI and DDTC Fiscal ResearchInternational Webinar , “Tax Administration Update from Past and Future Learning”

Nino Eka Putra ~ PR of FEB UI

DEPOK – (26/8/2020)

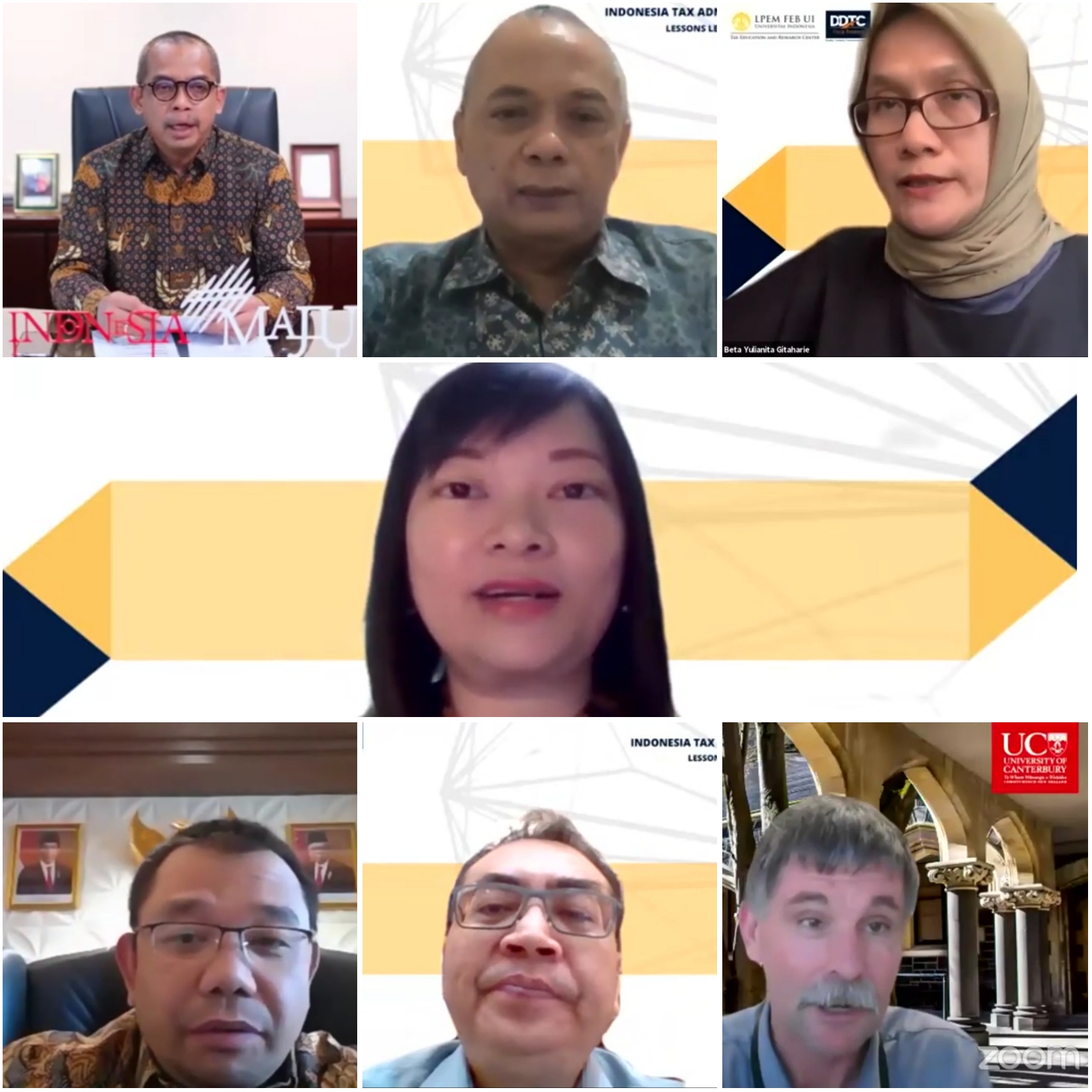

On Wednesday (26/8/2020), the Tax Education and Research Center, Institute for Economic and Community Research, Faculty of Economics and Business, Universitas Indonesia (TERC LPEM FEB UI) in collaboration with DDTC Fiscal Research held an International webinar, with the topic of “Indonesia Tax Administration Reform: Lessons Learnt and Future Direction ”.

Speakers for this webinar were Prof. Adrian Sawyer, Tax Researcher from the University of Canterbury New Zealand, Danny Septriadi, SE, M.Sc., LLM, Int., Tax, Senior Partner DDTC, and Yon Arsal, Ph.D., Assistant of Minister for Tax Compliance, Ministry of Finance RI. The webinar was moderated by Christine Tjen, SE, Ak., M.Int.Tax, CA., Coordinator of TERC FEB UI.

In her opening remarks, Dr. Beta Yulianita Gitaharie, Acting Dean of FEB UI, remarked that the tax administration reform process in Indonesia is a very important consideration for tax revenue as the main contributor for state revenue. Indonesia can also learn and emulate what has been done by its neighboring countries, namely New Zealand and Australia.

Mr. Darussalam, S.E., M.Si., L.L.M, Int., Tax, CA, Managing Partner of DDTC, spoke on the matter that tax management in Indonesia is not a static state. Reform must involve various aspects, starting from education and active participation of all parties. To this end, the collaboration between TERC LPEM FEB UI and DDTC Fiscal Research is a measure expected to strengthen the taxation reform process.

Furthermore, Mr. Suryo Utomo, Ph.D., Director General of Taxes of the Ministry of Finance of the Republic of Indonesia, gave a keynote speech stating that reforms must be carried out due to the fact that the Directorate General of Taxes (DGT) cannot avoid changes in the process of transforming in the dynamics of economic activities. Currently, the authority to enter the tax reform volume III is projected to be completed by 2024, with a focus on 5 pillars. These are, human resources, information technology and databases, organizational regulations, and business processes. The pillar of technology forms the backbone of DJP services to taxpayers; such as e-Filing or e-Invoicing and the 3C (Click, Call, Counter) scheme.

Presentation session on “Indonesia Tax Administration Reform: Lessons Learnt and Future Direction”

Adrian Sawyer, as the first speaker, explained that the motivation for Australia and New Zealand for their tax reform was to reduce their tax gap was to optimize overall tax revenue.

Based on reports for the 2015-2016 period, New Zealand has a tax gap ranging from 6.8% – 11.3% of gross domestic product (GDP). Meanwhile, Australia’s tax gap ranges from 7% – 8% of GDP.

Adrian stated that the “The reform process has been carried out by Australia and New Zealand in the last 30 years with almost the same close characteristics. For example, New Zealand began the reshuffle process in 1993 with a limited period of up to 15 years. One year later (1994), Australia started its tax reform process, which took up to 25 years and has not been completed to this day. As a matter of note, the two countries had experienced delays from their established targets.”.

Mr. Danny Septriadi, as the second speaker, conveyed that the most appropriate means to accommodate taxpayer rights is the Law on General Provisions and Tax Procedures (KUP). Thus, taxpayers will tend to comply with all their obligations if they know that their rights are protected by law and receive fair treatment from the tax authorities. The relationship between the authorities and taxpayers is currently in a confrontational atmosphere because it is generally viewed in relation to tax fines and penalties.

Mr. Danny also stated that “Later, with service-oriented relationships, trust will be built between the authorities and taxpayers. This will make taxpayers obedient and not feel burdened when paying taxes. The dimension of taxpayer rights is divided into 3 aspects, namely assurance of certainty related to interpretation of regulations and certainty of time for business processes involving taxpayers, guaranteeing that the tax system operates proportionally to ensure justice, and guarantees a fair judicial system for taxpayers.”.

The third speaker, Mr. Yon Arsal, added that the taxpayer account will be an application for taxpayers to monitor their rights as taxpayers, to be able to see all their tax rights and obligations. Including, monitoring if schedules are available and whether tax audits are required. In addition, taxpayers can also see their reporting track records and the value of taxes deposited into the state treasury, as well as facilities for taxpayers to file complaints in the event of account irregularities.

Mr. Yon Arsal added that “This application is one of the results of tax reform volume III, which is targeted for completion by 2024, and has the reliability of the DJP information system in the form of a core tax system to facilitate digital interaction between taxpayers and DJP. In addition, the core tax system is also an instrument for collaborating with ministries, other agencies and third parties for services and education,”. (hjtp)

(am)