Ari Kuncoro: Indonesia’s Economic Growth

Indonesia’s economic growth in 2019 of 5.02 percent. The decline in manufacturing industry growth cannot be sustained by other industries.

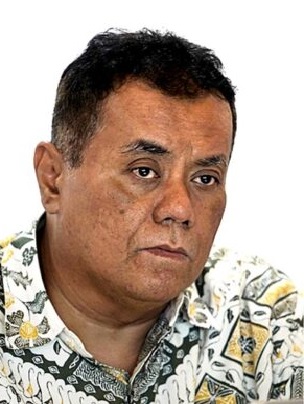

Ari Kuncoro: Chancellor of the University of Indonesia

The latest news from the Central Statistics Agency said that economic growth in 2019 was 5.02 percent. Meanwhile, if calculated on an annual basis, economic growth in quarter IV-2019 compared to quarter IV-2018 of 4.97 percent. From the production side, weakening growth in quarter IV-2019 mainly occurred in the manufacturing sector, which accounts for nearly 20 percent of gross domestic product (GDP). This figure decreased significantly from 4.14 percent on an annual basis in III-2019 to 3.66 percent in the fourth quarter of 2019.

A number of other sectors provide little compensation with a fairly high growth, although due to its portion under the manufacturing sector, a slight decline in economic growth continues. The agriculture sector, for example, grew 4.26 percent on an annual basis in quarter IV-2019, up from 3.12 percent. Provision of accommodation (hotels) and food (restaurants) increased sharply from 5.41 percent to 6.41 percent in quarter IV-2019. Transportation and warehousing jumped from 6.66 percent to 7.55 percent. Nevertheless, this is still not enough to lift GDP growth away from the steady state growth of 5.0 percent. This is because the trade sector, which accounts for around 13 percent of GDP, is also practically stagnant, even slowing down slightly from 4.43 percent to 4.24 percent.

Soft balance

This confirms that Indonesia in the past 6 years, after the end of the commodity bonanza in 2014, has remained in a steady state of the Solow-Swan style (1956) with a growth trajectory of 5 percent per year. The same thing happened to countries that are members of the G-20, which seems to be perched in a long-term balance. During the commodity bonanza, the 6 percent growth rate is the effect of the term of trade (TOT) increasing growth over the soft balance for a while. This model predicts that what can bring the economy to a higher permanent long-term balance is an increase in productivity, both contained in physical capital and human resources.

Conservatism of public spending

The main factor behind the growth performance of the manufacturing and trade sectors is the pattern of public spending that is more difficult to predict by a flood of information, both positive and negative, through various information media. Increased caution is perhaps the most appropriate term to describe current public sentiment. From the banking side, this situation is reflected in the shift in third party funds (DPK) from savings to time deposits. This situation has occurred since February 2019.

At that time, the unweighted growth in time deposits at book IV banks was 16.8 percent, while the industry average was 7.6 percent.

This shift still occurs until September 2019 even though it has subsided. It seems that because the new balance of holding more conservative liquid assets has begun to be achieved. The average deposit growth in book IV banks remained higher despite the thinner difference, which was 9.05 percent compared to 8.4 percent for the industry average.

The Consumer Tendency Index (ITK) issued by BPS showed an increase in optimism in quarter IV-2019 due to positive expectations of household income. Nevertheless, the component of the plan for purchasing durable goods has fallen, which shows that people are still holding back from spending money.

On the investment side, a business activity survey (SKDU) issued by BI showed that expansion in Q4 / 2019 slowed. The weighted net balance (SDT) of SKDU was 7.79 percent lower than 13.39 percent in quarter III-2019. In line with this, production capacity used and labor use were recorded lower in quarter IV-2019. Business activities that continue to grow positively occur in the sectors of finance, real estate, trade, hotels and restaurants, services as well as transportation and communication.

Except for trade and real estate, the business expectations survey is in accordance with the GDP sectoral growth data released by BPS.

The economic impact of the corona virus

The data and surveys above have not included changes in public expectations due to the frenetic new type of corona virus since late December 2019. What will clearly be directly affected are the hotel and restaurant sectors that are spreading to the trade sector. The transportation and warehousing sector will be more resilient due to the goods traffic component.