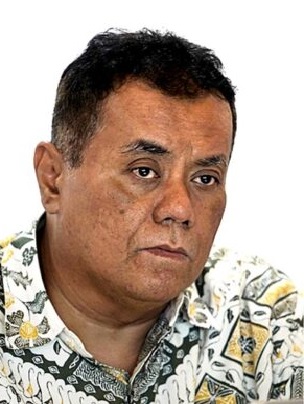

Ari Kuncoro: Pilot Business

Start-up efforts are still growing, even though they are starting to look for forms. Some succeed, some fail. The thing that should not be forgotten is that consumer protection must always take precedence.

Startup or start-up has been around for more than 10 years in Indonesia. Some succeed, but many more fail. Advances in information technology open up the possibility of reorganizing economic activities into something new. Gojek, for example, is a clearing house platform that starts from bringing together the supply side of the informal sector motorcycle taxi to the demand side, namely the community, which requires short distance transportation.

The entry and exit of a business unit into the industry is common, as part of the process by Schumpeter (1942) called creative destruction. New business units will bring new ideas, technology and management so that the industry experiences a revitalization so that it will not be weathered by the times.

In a more general context, this process is the change of production methods from the old to the new. The pioneering effort that was often associated with industry 4.0 was actually a repeat of the invention of the steam engine in 1750 (industry 1.0) and the use of technology for industry starting in 1870 (Industry 2.0) which led to mass production using Henry Ford’s assembly line, which was originally a start up for cars . The discovery of semi-conductors and industrial automation that led to the development of information technology, the invention of the internet, and the digitalization of industry, is the third wave (industry 3.0). Industry 4.0 is a consequence of the existence of industry 3.0 which allows the reorganization of production methods, with information technology as a platform.

Level of success

What is often forgotten, behind every successful startup, there are dozens or even hundreds of others who have failed. This is the phenomenon of the law of large numbers (Law of Large Number), which is to produce a handful of successful, it requires a number of other players who become incubators. This condition is very similar to the case of football, which is to produce a Lionel Messi from Barcelona, 99 other players are needed as training partners to form him as a superstar. The success rate of startups varies from country to country, around 5-10 percent. However, the opportunity to develop into a unicorn, even decacorn, such as Google, Facebook, Alibaba, to Grab and Gojek, makes there are investors who are willing to “burn money” to a certain extent. Opportunities for failures in startups are increasing at a time of slowing world economic growth, such as this, which will reduce investors’ willingness to provide capital.

Behind every successful start-up effort, there are dozens or even hundreds of others who have failed

In Indonesia, there are an estimated 150 million internet users. However, market potential alone is not enough to guarantee success. There are several factors behind the failure of 95 percent of startups. There are several characteristics that a founder needs to be successful. Most importantly, never get bored (passion) and commitment. Second, the willingness to adjust, but that does not mean it is always changing. Other factors are patience and perseverance, being willing to observe, listen and learn, fostering mentoring relationships with the right parties, as well as the principle of a pioneering effort that is streamlined and raising funds according to modest needs. Finally, a balance between technical and business knowledge with adequate technical expertise in product development.

Other important factors are more related to the market and the nature of the business. Most often, failure to recognize markets and produce products that are not in demand or are a priority of the community. Second, running out of funds because investors are retreating due to not being able to produce good performance and promising prospects. Other factors are not having a good team, losing competition, prices and costs that are not in accordance with market segments, poor product quality, do not have a clear business model, and do not have good marketing and do not care about customers.

The case of the closure of the Qlapa and Shopo startups which specialized in crafts was a combination of excessive specialization and low barrier to entry so competition was quite tight. Unlike the dynamic and ever changing modes, crafts have a slower turnover because customers may not change their home decor too often. In addition, artisans can enter the industry independently through Instagram without having to go through the market in a network created by a startup. Data on gross domestic product (GDP) from the production side shows, this sector is not very developed. The growth of wood products, wood crafts, and bamboo is only 2.62 percent, 2.57

percent on an annual basis, for the first, second and third quarters of 2019.

Macro Impact

The macroeconomic impact of startups is not very easy to track directly based on GDP data released by the Central Statistics Agency (BPS). What is clearly seen getting an abundance of pioneering business is precisely in the field of warehousing, postal, and courier logistics that accept trade orders electronically or e-commerce is increasing. Since mid-2015, this sector has always grown above the average GDP growth and the wholesale and retail trade sector. In fact, in 2019, the growth of this sector will be 8.28 percent, 9.69 percent and 11.28 percent respectively y for the first, second and third quarters. In addition to e-commerce logistics, a startup in the accommodation sector also supports consumer spending on hotels and restaurants which has grown above 5.22 percent on an annual basis since 2015.

What is clear is that it gets abundant from the business of this startup business, precisely in the field of warehousing, postal and courier logistics

The most important impact of this mushrooming start-up effort is the element of disruption as inspiration for old players to change themselves. Taxi companies, for example, have the opportunity to work together to minimize the use of fuel for hunting passengers and free time. The textile and garment industry has also regained its vitality by using online markets to market and sell products, influencing fashion trends, both online and outside the network through market exposure, including the acquisition of fashion houses. Indeed, there are still many problems that plague this sector, such as old machinery, flooding imports, rising wages, high logistics costs, and others. Textiles and garments are one of the middle class instruments for actualization so that the impact of start-up businesses is relatively more visible than other sectors. In some cases, there have been startups using the online market to introduce themselves as premium products. After being known by the public, they only opened an offline business. This is a smart strategy to save on promotional costs.

The textile and garment sector reached the lowest point in quarter II-2015 with negative growth of 6 percent. However, gradually his performance improved. In quarter IV-2017, this number has been positive and reached its peak in quarter II-2019 with growth of 20.71 percent on an annual basis, although it fell again to 15.74 percent on an annual basis in quarter III-2019. Policy implications of the positive impact of startups, with a small degree of success, there is no need for excessive entry restrictions on startups. What must be regulated is business transparency and financial reports so that business risks can be measured fairly by investors.

Consumer protection must also be carried out not to repeat criminal cases such as the Theranos health venture founded by Elizabeth Holmes whose story has been brought to the screen by HBO.