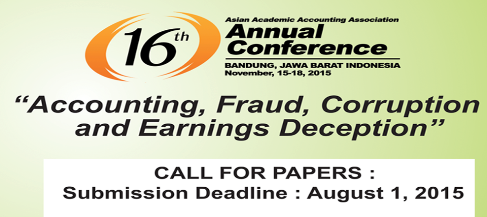

The 16th Annual Conference of Asian Academic Accounting Association (FourA) is held in collaboration with Accounting Department Faculty of Economics Universitas Indonesia (FEB UI). This is the third FourA conference held in Indonesia and the second collaboration between FourA and Accounting Department FEB UI, after the successful 12th annual conference in 2011.

This conference presents prominent speakers as well as outstanding reviewed papers written by academia from various countries. The program will be opened by a speech from Muliaman D. Hadad, PhD, Chairman of OJK Board of Commissioners. The keynote speech, which will address the main issue in this conference, will be delivered by Prof. Dr. Normah Omar, the Director of Accounting Research Institute (ARI) Malaysia. Other prominent speakers such as Etty Retno Wulandari, PhD., Prof Kamran Ahmed, Mr. Sulistyo Wibowo, Mr. Junino Jahja, Ms. Natalia Soebagjo, and Mr. Owen Hawkes will also contribute their thoughts in the panel sessions.In addition to keynote and panel sessions, 85 papers will be presented in concurrent sessions.

The theme of this conference is “Accounting, Fraud, Corruption and Earnings Deception”. Academically, this topic is interesting as most of the studies have concluded that corruption slows down the economic development of a country. The figures have indicated that in some developing countries, corruption amounts to a significant portion of the Gross National Products.

Referring to the definition in Law No. 13/1999, we found that corruption are not always linked with governmental institutions but it has also been linked with private institutions. We witnessed some credit fraud cases in the banking institutions where a high level of non-performing loans occurred due to collusion between bank’s loan officers and its debtors. In the capital market, we witnessed accounting fraud which was conducted by corporations (as the issuers of the securities instruments), this is done so for the purpose in obtaining low cost of capital through manipulating earnings reported to attract potential investors. In many cases, corruption might occur due to collusion between officials in government and private institutions. For example, illegal evasion of tax often deliberates two parties – the corporation (or individual) and the government officials in tax authority. The later require high skill and knowledge to do so, and thus, it is more difficult to uncover. Investigative audit might be required to uncover the high level of fraud.

This conference is organized with the aim to discuss the current issues related to accounting, fraud, corruption and earning deception both in public and private sectors, and to discuss how accounting as a discipline could play important roles in preventing and detecting fraud, bribery, and corruption in all aspects of the economy.